In an ever-changing financial landscape, diversifying your retirement portfolio is essential for long-term wealth preservation. A Gold IRA rollover offers individuals a unique opportunity to safeguard their retirement savings by investing in physical gold.

In this comprehensive guide, we explore the intricacies of the Gold IRA rollover process, providing valuable insights into the benefits, considerations, and steps involved. From understanding the advantages of gold as a tangible asset to navigating the rollover process and selecting a reputable custodian, we equip you with the knowledge needed to make informed decisions about protecting and growing your retirement wealth with the stability and value of gold.

Table of Contents

- The Gold IRA Rollover Guide For Smart Investors

- Best Gold IRA Companies

- IRA Or 401k Plan In The United States

- Gold Roth IRA

- Gold In The United States

- Why You Should Invest In Gold Now

- How To Buy Gold Bars And Bullion With An IRA

- Gold Vs Bitcoin: Safe Haven Assets

- Why Gold Is A Safe Strategy For Retirement

- I Have An IRA Or 401k. Can I Roll It Over Into A Precious Metals IRA?

- What Is A Gold IRA?

- What Is A 401k To Gold IRA Rollover?

- Benefits Of A Gold IRA Rollover

- Gold IRA Pros And Cons

- What Is A Gold IRA Custodian?

- Administrator Rules

- Contribution Limits

- Fees

- Tax Regulations

- How To Hold Physical Gold In An IRA

- Customer Service

- How To Hire A Gold IRA Company

- 4 Ways To Buy Gold With Your IRA

- #1. Birch Gold Group

- #2. GoldSilver

- #3. American Bullion

- #4. GoldCo

- Conclusion

A gold IRA is a tax-advantaged retirement account that investors in the United States get the luxury of choosing from.

Investors can rollover their existing 401k or IRA account into a physical precious metal-backed retirement account if they choose to do so.

In this guide, we will walk you through how you can get started TODAY.

Best Gold IRA Company

The Leading Dealer Of Physical Precious Metals In The United States

Best Gold & Silver IRA Company

The #1 Rated Gold And Silver IRA Company In The United States

The Gold IRA Rollover Guide For Smart Investors

Last Update July 15th, 2023. Imagine if you could invest your 401k into a gold IRA to have more control over your retirement.

Or even better: What if you could invest any retirement account into a gold IRA for the long term?

Lucky for you, that’s exactly what I’m going to share with you in this guide.

Everything you need to know about starting a gold IRA rollover today.

Disclosure: The owners of this website may be paid for sales or leads generated from recommendations or links to various investment opportunities. We strongly recommend seeking the advice of your financial adviser before making any investment.

Best Gold IRA Companies

| Company | Headquarters | Phone | Minimum Investment | Storage & Security | |

|---|---|---|---|---|---|

| Burbank, CA | (888) 877-0740 | $10,000 | Brinks, DDSC | |

| New York, NY | (888) 319-8166 | $10,000 | Brinks | ||

| Los Angeles, CA | (888) 987-6318 | $10,000 | DDSC | |

| Woodland Hills, California | (844) 515-4982 | $20,000 | Brinks, DDSC, IDS Texas |

IRA Or 401k Plan In The United States

A 401(k) is a tax-deferred retirement savings plan sponsored by an employer. Contributions are deducted from a portion of the worker’s salary for retirement. Taxes are not paid until the money is withdrawn from the account.

An Individual Retirement Account (IRA) is a tax-deferred retirement savings plan sponsored by many financial institutions. A Roth IRA is a tax-advantaged retirement savings plan that allows you to withdraw your savings tax-free.

Gold Roth IRA

It is certainly possible to place physical gold inside of a Roth IRA. With a Roth IRA, all taxes are paid upfront when contributions are made. You will not have to pay taxes on any subsequent growth and your withdrawals will not be taxed as income as they would with other retirement account types.

Gold In The United States

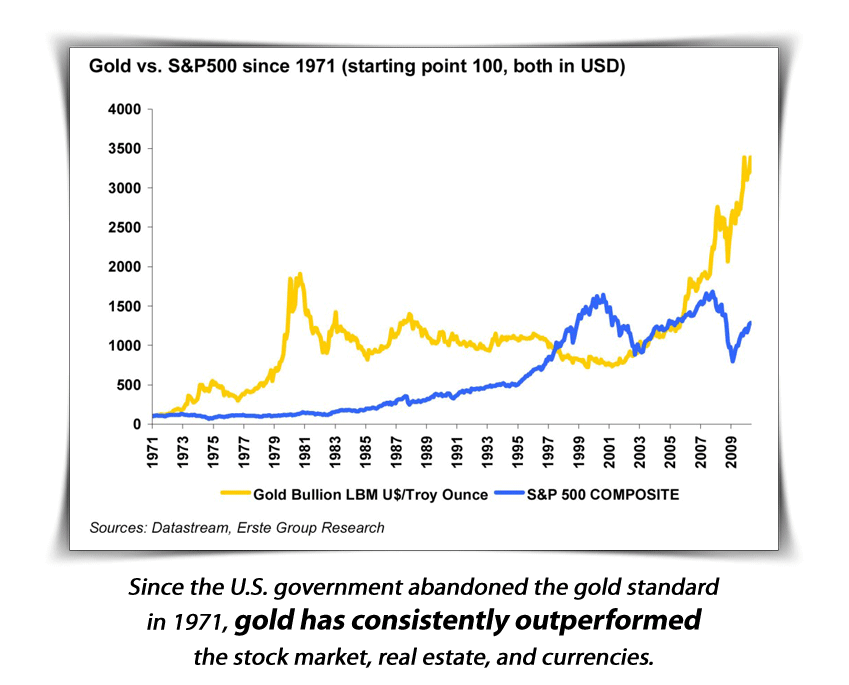

In the United States, gold has been linked to the dollar ever since the introduction of The Gold Standard. Since the dollar went off of The Gold Standard in 1971, gold has been considered an asset in its own right.

Since the financial crisis of 2008 and the resulting Great Recession, gold IRAs have become significantly more popular.

Gold stands the true test of time. If you pull out a $100 bill from your pocket, would you imagine that the value of the paper money costs $100? Not a chance! Yet, a 10 oz bar of gold from the 1600s still holds 10 oz worth of value in 2020, which has tremendous value.

As history shows, wealth moves in cycles and as currencies inflate, gold has a tendency to rise in value.

Billionaires and governments have been hoarding gold for decades. This is the greatest wealth transfer in history, thus it is the greatest opportunity in history.

One of the top reasons why the dollar is losing value is inflation. A growing national debt with interest to pay continues to force the government to print more paper money to stay afloat.

A declining interest rate is also a vital health sign of the economy. If this trend continues, your $100 today could soon be equal to $40.00 or even less.

As the dollar depreciates, that same value is NOT LOST but MOVED to another asset such as gold.

Why You Should Invest In Gold Now

Stocks and bonds have been affected by inflation.

Many people choose physical precious metals to safeguard their investment portfolios.

According to several financial analysts, gold could easily reach up to $5,000 an ounce! Do your own research to see if there is any truth to it.

Start your investigation with these key factors:

- Abolishment Of The Gold Standard

- The Size Of The US Government

- The Size Of Governments Around The World

- Inflation

- Interest Rate

Look at the relationship between these statistics and the purchasing power of the U.S. dollar. Gold’s value has endured for centuries while the value of the world reserve currency changes every century.

When looking at the historical price of gold it is clear that it is becoming a more sought after asset class today.

How To Buy Gold Bars And Bullion With An IRA

There are many ways in which you can buy gold bars and bullion. Many people choose to buy gold from a bullion dealer like GoldSilver. Others prefer to rollover a 401k with a licensed and insured gold IRA precious metals dealer like Birch Gold.

When buying gold make sure to only buy gold that has a recognized hallmark and proper stamping.

Gold Vs Bitcoin: Safe Haven Assets

Gold and bitcoin share many characteristics. They are both scarce, portable, fungible, divisible and don’t degrade over time.

There are 171,000 metric tons of gold in the world and 21,000,000 bitcoin that can ever be mined.

Why Gold Is A Safe Strategy For Retirement

The strength of the U.S. dollar has been of concern. The level of debt has reached epic proportions that make it impossible to reimburse. A default by a major financial institution or government would trigger a systemic collapse.

No one can only rely on paper money; as a matter of fact, the dollar is now valued at 98% less than it was in 1913.

“Gold has a 5,000-year history of being a store of value,” according to Edmund C. Moy, former United States Mint director, “Stocks can go to zero, as we have seen with Lehman Brothers, bonds can default like in Argentina or get big haircuts like in Greece. The value of the dollar has steadily gone down [at certain periods]. But gold will never be worth zero.”

Furthermore, the value of gold has risen every year [on average] since the removal of The Gold Standard in 1971 when gold was at $35 an ounce.

If your portfolio is balanced with both gold and paper-based investments, a loss on the gold side will be balanced by a gain experienced by other assets. Many of these risks exist for traditional IRAs too.

Owning gold has several benefits:

- Strong global demand

- Easy to buy and sell

- Satisfying to own

- Ability to test quality

- Not subject to political chaos

You may think we are only talking about purchasing gold for investment purposes, but no! We are talking about using gold as an insurance vehicle against inflation.

Bottom line: Gold is a financial asset that does not depend on credit to function. The precious metal is a proven safe haven from economic inflation.

I Have An IRA Or 401k. Can I Roll It Over Into A Precious Metals IRA?

Yes. You can rollover an existing 401k into a precious metals IRA and buy physical gold bars and bullion. A precious metals IRA is also a natural way to complement your existing IRA.

The entire process consists of submitting a simple form to give to your current IRA telling them where you want your money rolled over to.

A self-directed precious metals IRA puts you in the driver’s seat to set it up exactly in the way that is best for you. This way you don’t have to rely on whatever plan your company chose for you.

What Is A Gold IRA?

The precious metals IRA, also known as, a gold IRA, is a tax-advantaged vehicle for holding gold and precious metal assets.

The approval of the Tax Payer Relief Act of 1997 permitted diversification of gold and other precious metals into an IRA.

A gold IRA custodian simplifies the application process, purchases bullion and insures your bullion on your behalf. If you already own a large sum of physical gold, storing it inside of an IRA account is possible too.

The minimum investment for a gold IRA ranges from $10,000 to $50,000. Many times, the gold IRA custodian will waive the custodial fees for you, especially during the first year.

Precious Metals You Can Store In Your Gold IRA

Before 1997, the law only allowed American Silver and Gold Eagles within a gold IRA. Today, gold IRA portfolios allow the placement of gold, silver, palladium, and platinum bars and bullion.

What Is IRA Eligible Gold?

The precious metals in your IRA must meet a minimum fineness as required by the IRS:

- Gold – .995

- Silver – .999

- Platinum – .9995

- Palladium – .9995

The most common gold investment allowable within an IRA is the Gold American Eagle.

Gold Bars You Can Own In Your Gold IRA

Gold bars are one of the simplest forms of physical gold, as they are generally valued closer to the melt value than most other gold products on the market.

The most common is the one-ounce gold bar. Gold bars are produced in a variety of sizes including 1 kg, 10 oz, 1 oz, 100 grams, 50 grams, 20 grams, 10 grams, 5 grams, 2 grams, and 1 gram.

The dominant producers of gold bars in the world today include Credit Suisse, PAMP, Perth Mint, Royal Canadian Mint, Johnson Matthey and Engelhard.

Any gold bar that contains a minimum fineness of .995 is eligible to own in a gold IRA.

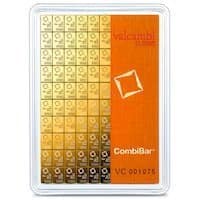

Valcambi CombiBars are produced by one of the world’s most trusted gold refiners, Valcambi Suisse. They are ideal for those seeking gold which can be broken down into smaller increments without any loss of material.

Each bar can be split into very small amounts potentially for use in a trade or as a gift.

Gold Bullion You Can Own In Your Gold IRA

Today the Gold American Eagle, Gold Canadian Maple Leaf, Gold American Buffalo, Gold Austrian Philharmonic, Gold Britannia, Gold Chinese Panda, and Gold Australian Kangaroo bullion are allowable investments within a gold IRA.

Introduced in 1986 to the United States by The United States Mint. The Gold American Eagle symbolizes many classic American concepts and is made only from gold mined in the United States. The design on the reverse showcases a bald eagle swooping into a nest holding its family with the words, “United States of America” inscribed. The Gold American Eagle is one of the most commonly traded gold bullion on the market.

Introduced in 1979 to Canada by The Royal Canadian Mint. The Gold Canadian Maple Leaf features the bust of her majesty Great Britain’s Queen Elizabeth II and has a purity of .9999. The design on the reverse features an image of a maple leaf with the word, “Canada” inscribed. The Gold Canadian Maple Leaf is internationally recognized as one of the best ways to hold gold.

Introduced in 2006 to the United States by The United States Mint. The Gold American Buffalo features the profile of a Native American and has a purity of .9999. The design on the reverse has the golden buffalo depicted with the words, “United States of America” inscribed. The Gold American Buffalo was created to compete with the world bullion coins in purity and fineness.

Introduced in 1989 to Austria by the Austrian Mint in Vienna. The Gold Austrian Philharmonic features instruments used by the orchestra and has a purity of .9999. The design on the reverse depicts the great organ in Musikverein Golden Hall with the words, “Republik Osterreich” inscribed. The Gold Austrian Philharmonic is the only legal tender gold coin mass-produced in Europe.

Introduced in 1987 to Britain by The Royal Mint. The Gold Brittania showcases a portrait of Britannia and has a purity of .9999. The design on the reverse features the iconic Britannia standing design demonstrating the spirit of the British Isles with the word, “Britannia” and the year inscribed. The Gold Britannia is manufactured by one of the world’s oldest organizations.

Introduced in 1982 to China by the Peoples Bank Of China. The Gold Chinese Panda features the Temple of Heaven as a symbol of peace and humbleness and has a purity of .9999. The design on the reverse has a Chinese Panda with her cub. The Gold Chinese Panda is made from gold found in China and is popular among investors and coin collectors around the globe.

Introduced in 1986 to Australia by The Perth Mint. The Gold Australian Kangaroo features an Australian Kangaroo exploring wildlife and has a purity of .9999. The design on the reverse features a portrait of Queen Elizabeth II with the word, “Australia” inscribed. The Gold Australian Kangaroo can be purchased in 1⁄20 oz, 1⁄10 oz, 1⁄4 oz, 1⁄2 oz, 1 oz, 2 oz, 10 oz, and 1 kg denominations.

Restricted gold investments within an IRA include the Mexican 50 Peso Gold Bullion Coin. Rare coins such as the Saint Gaudens, Liberty Head, British Sovereign and Swiss Franc are also restricted.

Retirement Accounts Eligible For A Gold IRA Rollover

The following types of retirement accounts are eligible for rollover into a gold-backed IRA:

- 401(k)

- 403(b)

- Roth IRA

- Traditional IRA

- SEP IRA

- SIMPLE IRA

- Pension plans

- Various annuity plans

- TSP (Thrift Savings Plans)

The most common rollover is the 401k to gold IRA rollover.

What Is A 401k To Gold IRA Rollover?

A 401k to gold IRA rollover is a transfer of paper assets to physical gold bullion and bars. A notable share of the legwork is done by the new company contacting the old company directly.

If you already have a 401k or IRA, either traditional or Roth, then you have the option of rolling over some or all of its funds into a gold IRA. A gold IRA is the same as any other IRA, only instead of holding paper assets, a gold IRA holds physical bullion or bars.

The 401k to gold IRA rollover process is simple.

- Step 1: Fill out an account application

- Step 2: The account is established within 24-48 hours

- Step 3: Receipt of the signed transfer request by both custodians

- Step 4: Fund your account

- Step 5: Order your gold bullion and bars

Carry out research on your current investment management company. Gauge their level of expertise in independent precious metals.

If a 401k to gold IRA rollover makes sense for you, find an investment company that specializes in precious metals.

Keep in mind that a general rollover has to be disclosed and reported to the Internal Revenue Service. Rollovers can close within sixty days. Concerning difficulty and time, rollovers are trouble-free for the investor.

Benefits Of A Gold IRA Rollover

- Diversification

- Risk Mitigation

- Self-Directed Retirement Account

Physical gold offers true diversification, solid protection, and profit potential. Anyone with a retirement account can enjoy a rollover into precious metals.

Can I Set Up A Gold IRA For My Spouse?

Absolutely! This is a common practice for many married households.

Can I Schedule Automatic Contributions To My Gold IRA?

Yes. Your custodian can help you set up an automatic contribution plan.

Can I Cash Out Some Or All Of My Gold IRA?

Yes. You can take money out of your IRA at any time in the form of cash or physical bullion. You will incur a tax penalty for withdrawing if you are still working. We recommend that you consult with an accountant before making a withdrawal to make the most out of your tax advantages.

Gold IRA Pros And Cons

Before deciding on a gold IRA company it is important to understand the pros and cons of this highly specific investment.

Pros

- Gold maintains its value

- Gold is a wise long term play

- Gold provides portfolio insurance

Cons

- Gold only yields gold

- Gold is a long game

- Gold can’t be spent easily

What Is A Gold IRA Custodian?

A gold IRA custodian is the company or private dealer who handles the paperwork, storage, and security of your physical gold or other approved precious metals. Gold IRA custodians typically partner with precious metals dealers (or companies) to help their clients open and fund precious metals IRAs.

| Company | Headquarters | Phone | Minimum Investment | Storage & Security | |

|---|---|---|---|---|---|

| Burbank, CA | (888) 877-0740 | $10,000 | Brinks, DDSC | |

| New York, NY | (888) 319-8166 | $10,000 | Brinks | ||

| Los Angeles, CA | (888) 987-6318 | $10,000 | DDSC | |

| Woodland Hills, California | (844) 515-4982 | $20,000 | Brinks, DDSC, IDS Texas |

Administrator Rules

If you want to own a gold IRA, you are required to open it with an IRS approved administrator who handles precious metals.

Although you control ownership of the precious metals assets, administrators i.e. brokers, custodians, etc are necessary to oversee your IRA account on your behalf.

Contribution Limits

If you are under the age of 50, you are able to contribute up to $6,000 per year. This limit increases to $7,000 annually once you turn 50 years of age.

Fees

There is a custodial fee to roll over your existing retirement account to a gold IRA account. Give your chosen gold IRA company a call to learn more about their investment fee structure.

Retirement Account Setup

This one-time fee is charged to establish your new IRA account. The fee amount depends on the custodian and account type you are rolling over from.

Seller’s Fee (Markup)

The gold IRA company will mark up the going rate depending on whether you want gold bars, bullion, coins, etc. The markup amount varies depending on the vendor.

Custodian Fees

Almost all IRAs have annual fees. Most gold IRA custodians have an annual fee for security and upkeep. This fee is usually waived for the first year.

Storage Fees

Every precious metals dealer has its own fees for storage in their vaults.

Tax Regulations

Unless you have a Roth IRA, distributions are subject to income tax at the time of withdrawal.

How To Hold Physical Gold In An IRA

Your precious metals that make up an IRA are kept within fully-insured and segregated precious metal vaults approved by the IRS.

Six IRS approved depository vaults hold practically all of the gold that makes up every gold IRA account in the United States.

The six vaults are:

- Brinks Security

- CNT Depository

- Delaware Depository

- HSBC Bank USA

- JPMorgan Chase Bank North America

- Scotia Mocatta

International vault options in places like London, Singapore or Dubai are also available for those who fear confiscation in the United States.

The offshore IRS approved vaults include:

- Brinks Security – London

- HSBC Bank USA – Hong Kong, London, Singapore, Zurich

- JPMorgan Chase Bank – London and Singapore

- Scotia Mocatta – Toronto

Your gold is owned under your name and protected with the strictest security measures. Each precious metals dealer stores and secures precious metals differently so give your chosen one a call to learn more about their storage policies.

Actual possession of the gold is considered a distribution by the IRS, which means gold is subject to taxes or penalties.

Customer Service

Find a precious metals dealer that is both friendly and professional. Every company has a direct line which you can call should you have any questions about your physical precious metals or IRA account.

How To Hire A Gold IRA Company

A self-directed IRA is a type of retirement account that is legally structured like a traditional or Roth IRA and gives you full control of the assets you own. Look out for the following factors before hiring a gold IRA company.

Insurance: Working with a company that is insured and bonded is critical because this means the company is legitimate. If in any case, a calamity befalls the company you will be sure of getting your investment back.

License: The law requires all precious metals dealers to be licensed by the Internal Revenue Service. This ensures that the company you want to work with has the necessary license to do business.

Choosing the right company for your gold IRA requires due diligence on your part to research their reputation, customer service, and retirement plans offered.

- Are they accredited with the BBB (Better Business Bureau)?

- How many years of experience do they have?

- In case of a physical disaster or emergency, how can I access my funds?

- What kind of asset preservation program do they have?

- Will you have your own representative or hotline should any questions arise?

A good precious metals dealer will minimize the risks involved with opening an account and alleviate any concerns you may have. Your custodian handles the safekeeping and storage of your precious metals.

If you have a specific question regarding opening a gold IRA, give your favorite precious metals dealer a call directly so they can answer it for you.

The Simple Stress-Free Gold IRA Rollover Process:

Step 1: Fill out an account application

Step 2: The account is established within 24-48 hours

Step 3: Receipt of the signed transfer request by both custodians

Step 4: Fund your account

Step 5: Order your gold bullion and bars

“I have never been a gold bug, it is just an asset that, like everything else in life, has its time and place. And that time is now.” – Paul Tudor Jones, Founder, Tudor Investment Corporation

4 Ways To Buy Gold With Your IRA

Gold creates protection for your portfolio as a store of wealth and has outlasted the world’s currencies. By starting a Gold IRA, you are making gold a part of your lifestyle.

#1. Birch Gold Group

| Website: | birchgold.com |

| Phone: | (888) 877-0740 |

| Headquarters: | Burbank, California |

| Founded: | 2003 |

| Minimum: | $10,000 |

Birch Gold Group has been in business since 2003 and is a leading dealer of precious metals and precious metal IRAs in the United States. They have a team of experienced professionals, wealth managers, financial advisors, and commodity brokers to help customers diversify their portfolios with gold, silver, platinum, and palladium.

With Birch Gold, you have a Precious Metals Specialist assigned to you to help make the entire purchase process smooth and simple.

Why Invest With Birch Gold Group?

- Excellent and attentive service from start to finish.

- You are matched with a personal precious metals specialist 1-to-1 who will get to know you and your specific needs and goals.

- Endorsed by Ben Shapiro, host of the Ben Shapiro Show and Editor-in-Chief of The Daily Wire.

- Decades of combined experience, including past positions with Citigroup, Dun & Bradstreet, and IBM.

- Maintains an A+ rating with the Better Business Bureau, an AAA rating from the Business Consumer Alliance and 5-star ratings on Consumer Affairs and GoldDealerReviews.com

Summary: The people at Birch Gold Group are very easy to work with. They are one of the best rated and most experienced precious metals dealers in the country.

REMEMBER: Birch Gold Group has a very knowledgeable customer support team and can answer any question regarding precious metals and IRAs in-depth over the phone

Birch Gold Group Company Information

Address: 3500 West Olive Avenue, Suite #300, Burbank, California 91505

Country: United States

Phone: +1 (888) 877-0740

International: 001-888-877-0740

Website: birchgold.com

“The desire of gold is not for gold. It is for the means of freedom and benefit.” – Ralph Waldo Emerson

#2. GoldSilver

| Website: | goldsilver.com |

| Phone: | (888) 319-8166 |

| Headquarters: | New York, New York |

| Founded: | 2005 |

| Minimum: | $10,000 |

Founded by Mike Maloney in 2005, GoldSilver is a globally renowned gold and silver bullion dealer serving every region of the world.

GoldSilver sells precious metals in all forms including bars, bullion, and jewelry. They have many resources for those who want to learn more about the industry.

GoldSilver is a great option if your current 401k or IRA custodian doesn’t allow physical precious metals. With GoldSilver, investors are able to rollover their existing 401 or IRA and buy physical gold and silver bullion. If your IRA is one of your primary investment vehicles, your gold and silver can grow tax-free within it.

Why Invest With GoldSilver?

- GoldSilver is a worldwide leader in educating investors on gold and silver.

- Simplified 4-step self-directed gold IRA rollover process.

- 100% allocated and segregated private vault storage and insurance operated by Brinks.

- Gold and silver bullion ships in nondescript packaging.

- International shipping is available for every country in the world.

Summary: GoldSilver is a trusted precious metals company and has a responsive customer support staff. To place a gold IRA or silver IRA order contact a sales representative at GoldSilver to get started with a wire of funds right away.

REMEMBER: GoldSilver is also a world-class bullion dealer and carries a large selection of gold and silver bars and bullion (in addition to jewelry).

GoldSilver Company Information

Address: 909 3rd Avenue #8525 New York, NY 10150

Country: United States

Phone: +1 (888) 319-8166

International: 001-888-319-8166

Website: goldsilver.com

“Gold and silver are money… Everything else is credit.” – J.P. Morgan, Founder, J.P. Morgan & Co.

#3. American Bullion

| Website: | americanbullion.com |

| Phone: | (888) 987-6318 |

| Headquarters: | Los Angeles, California |

| Founded: | 2009 |

| Minimum: | $10,000 |

American Bullion is a pioneer in bringing the original Gold IRA into existence. They are still leading retirement investors by teaching them how to build and protect their hard-earned assets. The company helps clients transfer existing IRAs or 401ks into a physical gold IRA, hassle-free.

American Bullion is a U.S. Mint Dealer since 2010, and also a Royal Canadian Mint Registered Bullion DNA Dealer. They are a member of the American Numismatic Association (ANA), as well as ICTA, PCGS, NGC and more. The company was selected as the “Bullion Dealer Of The Year” in 2017 with a special reward as “The Gold Retirement Specialists”.

Why Invest With American Bullion?

- Delivers millions of dollars’ worth of gold and silver monthly to clients.

- Carries all U.S. and European pre-1933 coins, as well as modern gold and silver bullion.

- Offers a wide array of precious metal coins and bars for sale, insured and delivered to your chosen location.

- Works with the Delaware Depository to ensure compliance with IRS requirements.

- Maintains a $1 billion policy in all-risk precious metals insurance underwritten by Lloyds of London.

Summary: American Bullion is a proven gold IRA specialist that takes great pride in its customer service. They are a leader in adding precious metals to individual retirement accounts.

REMEMBER: Rollovers require approximately 10-15 business days to complete. The process is dependent on your current IRA or 401(k) custodian and their procedures for releasing your funds.

American Bullion Company Information

Address: 12301 Wilshire Boulevard Suite 305, Los Angeles, CA 90025

Country: United States

Phone: +1 (888) 987-6318

International: 001-888-987-6318

Website: americanbullion.com

Free Gold Guide: americanbullion.com/freegoldguide

“People view gold as emotional, but when they demythologize it, when they look at it for what it is and the opportunity it represents, they’re going to say, ‘We really should own some of that.’ The question will then change to ‘Where do we get the gold?’” – Thomas Kaplan, Chairman, The Electrum Group LLC

#4. GoldCo

| Website: | goldco.com |

| Phone: | (844) 515-4982 |

| Headquarters: | Woodland Hills, California |

| Founded: | 2006 |

| Minimum: | $20,000-$25,000 |

GoldCo specializes in helping its clients diversify their IRA, 401(k), TSP or other qualified retirement accounts into gold, and silver protecting them from runaway inflation, future stock market crashes, and government debt.

GoldCo provides expert “white glove service” from start to finish for precious metals IRA and non-IRA transactions. First-year fees are waived for orders over $50,000. You also get 5% back in free metals on any qualified order over $50,000.

The company has strategic partnerships with the most experienced and reliable custodians and depositories. They are willing to provide personalized service for every client they take on.

Why Invest With GoldCo?

- With a Goldco® Self-Directed IRA account, you can invest in gold just like stocks or bonds in a conventional IRA.

- GoldCo uses Equity Trust Company as its custodian for precious metals accounts.

- When you open a Goldco Precious Metals IRA, your gold, silver and other precious metals are transferred to a secure vault in an IRS-approved depository.

- Provides free storage for non-IRA transactions.

- Maintains an A+ rating with the Better Business Bureau and 5-star ratings on consumer trust sites like Consumer Affairs, Trustlink, and TrustPilot.

Summary: Customer service is where Goldco really shines! GoldCo promises personalized attention for every client they take on and is one of the leading precious metals dealers in the country.

REMEMBER: Once funds are received into the account, an Account Executive will reach out to you to choose the metals to be purchased and held in your IRA. The precious metals will be placed directly into your chosen depository for storage within a few days.

GoldCo Company Information

Address: 21215 Burbank Blvd #600, Woodland Hills, CA 91367

Country: United States

Phone: +1 (844) 515-4982

International: 001-844-515-4982

Website: goldco.com

Free Gold IRA Guide: goldco.com/freegoldiraguide

“Gold maintains its intrinsic value better than anything else on Earth” – Steve Forbes, CEO of Forbes, Inc.

Conclusion

As we conclude our comprehensive Gold IRA rollover guide, it becomes evident that diversifying retirement portfolios with physical gold can provide a secure and stable foundation for long-term wealth preservation. The process of executing a Gold IRA rollover involves careful consideration, from selecting a reputable custodian to acquiring and storing physical gold.

By understanding the advantages, risks, and intricacies of this investment strategy, individuals can confidently make informed decisions to protect and grow their retirement savings. As the economic landscape evolves, the timeless value and stability of gold continue to serve as a reliable asset for securing a prosperous retirement. Embrace the opportunities presented by a Gold IRA rollover and secure your financial future with the enduring strength of gold.